Vea también

27.01.2026 01:16 AM

27.01.2026 01:16 AMAt the time of writing on Monday, the AUD/USD pair is trading around 0.6922, having gained 0.55% for the day and maintaining positive momentum at the start of the week. The pair receives support from a combination of domestic Australian drivers and ongoing pressure on the US dollar amid political and monetary uncertainty in the US.

The Australian dollar is buoyed by expectations for the release of the Consumer Price Index (CPI) for the fourth quarter and December 2025, scheduled for Wednesday. Forecasts suggest quarterly inflation will rise to 3.6% year-on-year, compared to 3.2% previously, confirming that price pressures remain above the Reserve Bank of Australia (RBA) target. Stronger-than-expected CPI data would fuel speculation about an imminent interest rate hike. According to Reuters estimates, the probability of a rate hike at the RBA's upcoming meeting next week is about 60%.

Recent macroeconomic data in Australia also support this trend. Economic activity indicators, including Purchasing Managers' Index (PMI) readings in both the manufacturing and services sectors, have risen; the labor market is strengthened by increases in employment and declines in unemployment. These signals reinforce the belief in the economy's resilience to further monetary policy tightening, even as RBA officials acknowledge a significant decrease in inflation from its 2022 peak.

Additionally, the weakness of the US dollar before the announcement of the new Fed chair provides further momentum for AUD/USD—an event that markets perceive as a potential risk for the dollar if future policy is seen as aligning with the administration's agenda.

To secure better trading opportunities, it is advisable to await the Fed's decision this week, with the consensus forecast indicating that interest rates will remain unchanged in the 3.50%-3.75% range.

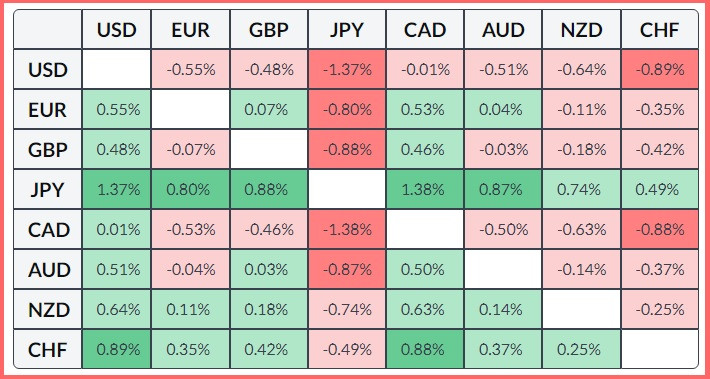

Ultimately, AUD/USD remains highly sensitive to Australian inflation data and shifts in global expectations for monetary policy. Confirmation of rising inflation in Australia would strengthen the national currency's position, while a soft surprise from the RBA or a rebound in the US dollar could slow the pair's upward momentum. The table below reflects the dynamics of the Australian dollar against key currencies for the day.

The Australian dollar has shown the strongest performance against the US dollar. From a technical perspective, oscillators on the daily chart are in overbought territory, suggesting a correction may be forthcoming. Support in this case could be the round level of 0.6900.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.