Lihat juga

12.12.2025 05:56 PM

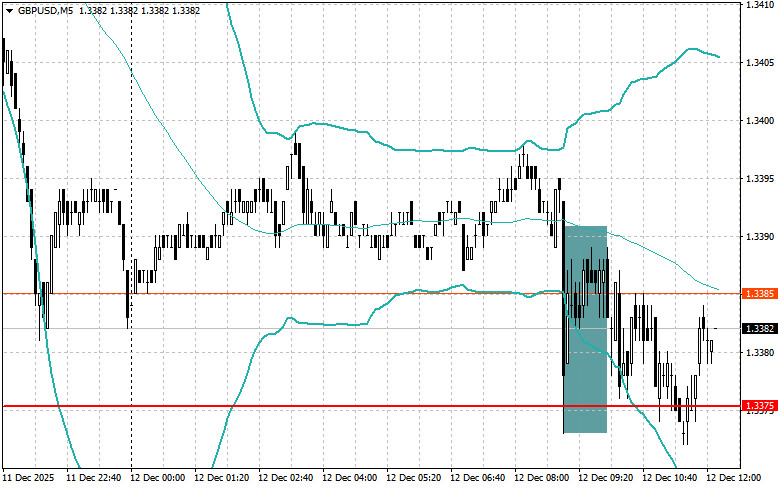

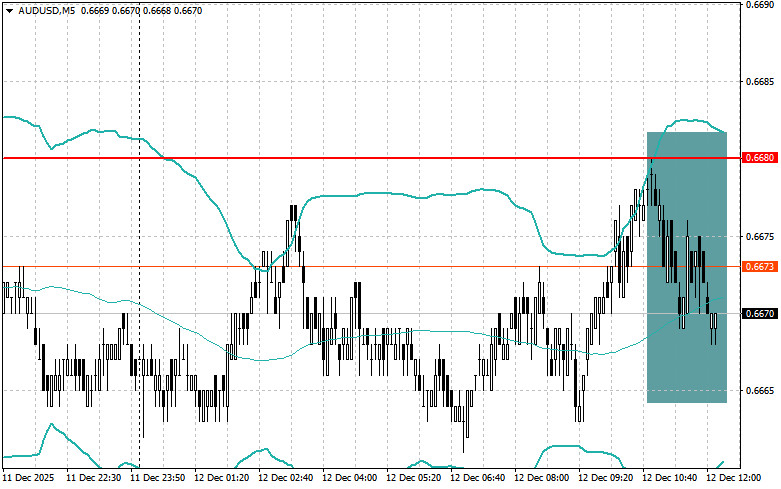

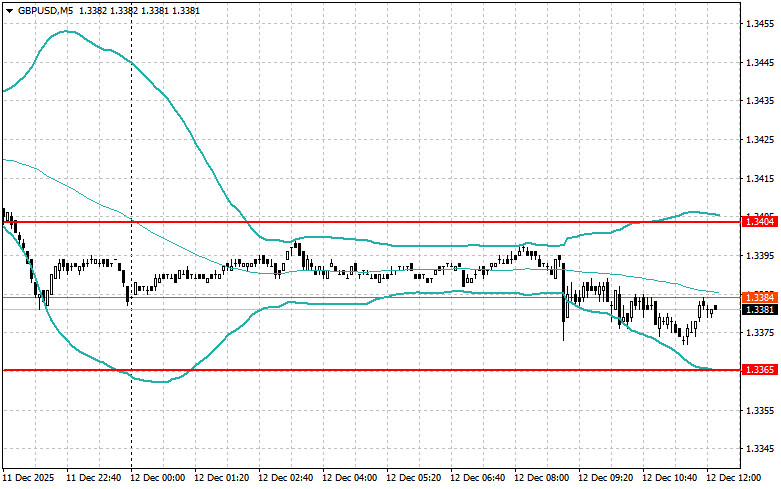

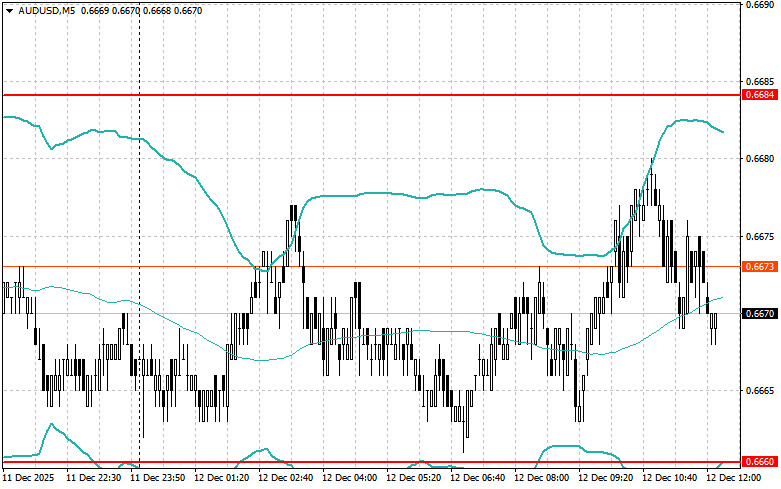

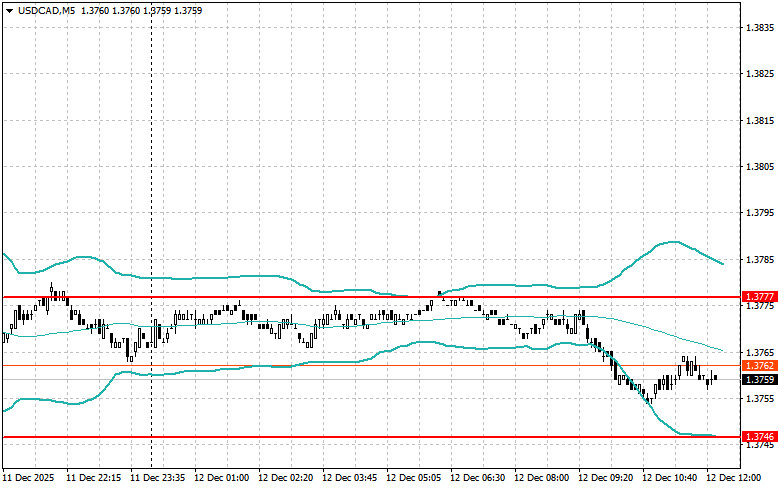

12.12.2025 05:56 PMToday, the British pound, Australian dollar, and Canadian dollar were traded using the Mean Reversion strategy. I traded only the Japanese yen using the Momentum strategy.

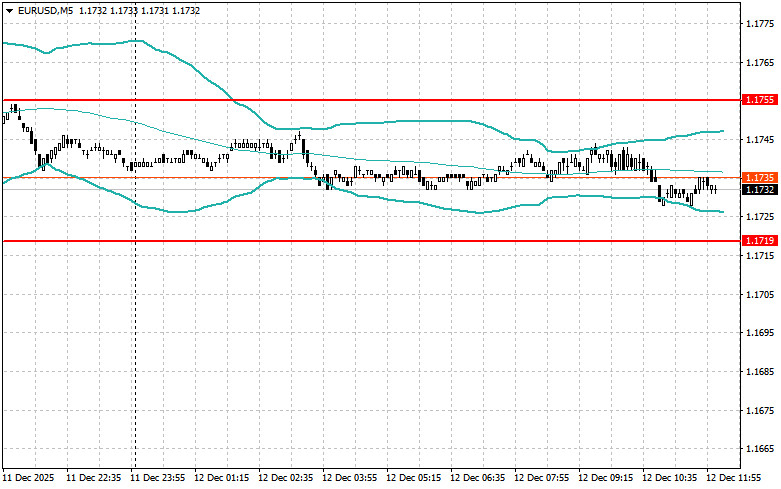

Inflation data from the eurozone matched economists' forecasts, which kept volatility in the EUR/USD pair at a low level. However, despite stable macroeconomic indicators, market sentiment remains on the side of euro buyers. The British pound did not face major difficulties after the release of weak UK GDP data for October of this year.

During the U.S. trading session, there will be no economic statistics from the U.S. at all, so attention will shift to the speeches by FOMC members Beth M. Hammack and Austan D. Goolsbee. Traders will closely watch for any hints regarding the Federal Reserve's future monetary policy. Markets are hoping for more clarity regarding the timing and scale of potential interest rate cuts next year. Any disagreements among FOMC members may trigger volatility in financial markets.

Special attention will be given to statements from Beth M. Hammack, known for her conservative stance, while Austan D. Goolsbee is generally more inclined toward economic stimulus.

If strong data emerges, I will rely on the Momentum strategy. If the market does not react to the data, I will continue using the Mean Reversion strategy.

Momentum Strategy (breakout trading) for the second half of the day:

Mean Reversion Strategy (reversal trading) for the second half of the day:

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.